QuantumScape (QS) has captured significant attention in the electric vehicle (EV) battery sector, marked by both substantial gains and considerable volatility. Investors are keenly watching its progress, especially regarding its solid-state battery technology, which promises enhanced energy density and safety compared to traditional lithium-ion batteries. This article delves into the factors influencing QuantumScape’s stock performance and helps assess whether it’s a worthwhile investment now.

The company’s journey has been characterized by peaks and valleys, reflecting the inherent risks and potential rewards of investing in early-stage technology companies. Recent partnerships and technological advancements have fueled optimism, while market corrections and financial realities have tempered enthusiasm. Understanding these dynamics is crucial for making an informed decision about QuantumScape stock.

Evaluating QuantumScape’s Potential

QuantumScape’s allure lies in its solid-state battery technology, which aims to revolutionize the EV industry. However, potential investors need to weigh the company’s progress against its challenges.

Technological Advancements and Partnerships

QuantumScape has made strides in its technology, particularly with its solid-state battery separators. A notable partnership with Corning, announced in September, focuses on developing these separators, which are critical for battery performance and safety. This collaboration aims to leverage Corning’s expertise in glass technology to enhance QuantumScape’s battery design.

The company’s innovations target key limitations of current lithium-ion batteries, such as energy density, charging time, and safety. Solid-state batteries promise to address these issues, potentially offering longer ranges, faster charging, and reduced fire risk in EVs. Such advancements are vital for QuantumScape to maintain a competitive edge and attract further investment.

Financial Health and Market Position

Despite technological progress, QuantumScape faces financial hurdles typical of companies in the development phase. The company is not yet generating significant revenue, relying instead on funding to support its research and development efforts. This financial position makes the stock sensitive to market sentiment and investor confidence.

Market conditions also play a crucial role. The EV sector is highly competitive, with established players and emerging startups vying for market share. QuantumScape’s success depends on its ability to scale production, secure strategic partnerships, and demonstrate the superiority of its technology over existing and emerging alternatives.

Analyzing Recent Stock Performance

QuantumScape’s stock has experienced significant volatility, influenced by news, market trends, and investor speculation. A review of recent performance provides insights into the factors driving these fluctuations.

Stock Surge and Subsequent Correction

In the past year, QuantumScape’s stock has seen dramatic swings. Positive announcements, such as the ceramic separator partnership, have triggered substantial surges, with the stock jumping as much as 184% on such news. However, these gains have often been followed by corrections, reflecting broader market trends and profit-taking.

For instance, after a notable run-up, the stock experienced a significant drop, highlighting the risks associated with investing in growth-dependent companies. These fluctuations underscore the importance of a long-term investment perspective and a tolerance for volatility when considering QuantumScape.

Factors Influencing Stock Movement

Several factors contribute to QuantumScape’s stock movements. These include:

- Technological Milestones: Positive test results and advancements in battery technology tend to drive the stock upward.

- Partnerships and Collaborations: Announcements of new partnerships boost investor confidence.

- Market Sentiment: Overall market conditions and investor sentiment toward EV stocks impact QuantumScape’s valuation.

- Financial Reports: Earnings reports and financial updates provide insights into the company’s cash flow and spending, affecting investor perceptions.

These elements collectively shape the risk-reward profile of QuantumScape stock, requiring investors to stay informed and adaptable.

Weighing the Risks and Rewards

Investing in QuantumScape involves a careful assessment of potential risks and rewards. The company’s innovative technology offers substantial upside, but its financial position and market challenges present significant risks.

Potential Upside

The primary appeal of QuantumScape lies in its potential to revolutionize the EV battery market. If its solid-state battery technology proves successful, the company could capture a significant share of the growing EV market. This potential is reflected in analyst ratings, with some suggesting the stock could see substantial gains if the technology is successfully commercialized.

Moreover, the increasing demand for EVs and the limitations of current battery technology create a favorable environment for QuantumScape. The company’s ability to deliver on its promises could result in significant revenue growth and stock appreciation.

Key Risks

However, several risks must be considered:

- Technological Hurdles: The development of solid-state batteries is complex, and there is no guarantee that QuantumScape will overcome all technological challenges.

- Financial Constraints: The company’s reliance on funding and lack of current revenue make it vulnerable to financial risks.

- Competition: The EV battery market is competitive, with established players and startups developing alternative technologies.

- Market Volatility: QuantumScape’s stock is highly volatile, and investors should be prepared for significant price swings.

These risks highlight the speculative nature of investing in QuantumScape, requiring a long-term perspective and a high-risk tolerance.

Expert Opinions and Analyst Ratings

Analyzing expert opinions and analyst ratings provides additional perspectives on QuantumScape’s prospects. These insights can help investors gauge the stock’s potential and make informed decisions.

Overview of Analyst Ratings

Analyst ratings on QuantumScape vary, reflecting the uncertainty surrounding the company’s future. Some analysts are optimistic, citing the potential of its technology and the growing demand for EVs. Others are more cautious, pointing to the risks and challenges the company faces.

For example, some analysts have set price targets significantly higher than the current stock price, suggesting potential upside. However, it’s important to note that these ratings are based on assumptions and projections that may not materialize. Investors should consider a range of opinions and conduct their own due diligence.

Expert Perspectives

Industry experts offer valuable insights into QuantumScape’s technology and market position. These perspectives can help investors understand the company’s strengths and weaknesses.

Experts often emphasize the importance of QuantumScape’s solid-state battery technology, noting its potential to overcome the limitations of current lithium-ion batteries. However, they also caution that the technology is still in the development phase and faces significant challenges. Investors should consider these expert opinions in the context of their own investment goals and risk tolerance.

Strategic Considerations for Investors

For investors considering QuantumScape, several strategic considerations can help mitigate risks and maximize potential returns.

Long-Term Investment Horizon

Given the speculative nature of QuantumScape’s stock, a long-term investment horizon is crucial. The company’s success depends on the successful development and commercialization of its technology, which could take several years. Investors should be prepared to hold the stock for the long term, weathering potential market fluctuations.

A long-term perspective allows investors to benefit from the potential upside of QuantumScape’s technology while mitigating the impact of short-term volatility. This approach aligns with the company’s development timeline and the evolving dynamics of the EV market.

Diversification

Diversification is essential for managing risk when investing in QuantumScape. Investors should avoid allocating a disproportionate share of their portfolio to a single stock, especially one as speculative as QuantumScape. Spreading investments across different sectors and asset classes can help mitigate the impact of any single investment’s performance.

Diversification reduces the overall risk of the portfolio and allows investors to participate in the potential upside of QuantumScape without exposing themselves to excessive risk. This strategy is particularly important for investors with a low-risk tolerance.

Staying Informed

Staying informed about QuantumScape’s progress and market trends is crucial for making informed investment decisions. Investors should regularly monitor the company’s financial reports, technological developments, and partnerships. They should also stay abreast of broader trends in the EV market and the competitive landscape.

Informed investors are better equipped to assess the risks and rewards of investing in QuantumScape and to make timely adjustments to their investment strategy. This proactive approach can help investors maximize their returns and minimize their losses.

QuantumScape’s Competitive Landscape

Understanding QuantumScape’s position relative to its competitors is vital for assessing its long-term viability and investment potential.

Key Competitors

QuantumScape operates in a competitive landscape that includes established battery manufacturers and other companies developing advanced battery technologies. Key competitors include:

- Solid Power: Another company focused on solid-state battery technology.

- Toyota: A major automaker investing heavily in solid-state battery research.

- CATL: The world’s largest battery manufacturer, developing advanced lithium-ion and solid-state batteries.

- LG Energy Solution: A leading battery supplier for EVs, also exploring solid-state technology.

These competitors pose a significant challenge to QuantumScape, requiring the company to innovate and execute effectively to maintain its competitive edge.

QuantumScape’s Differentiators

QuantumScape aims to differentiate itself through its unique solid-state battery technology, which promises higher energy density, faster charging, and improved safety compared to traditional lithium-ion batteries. The company’s ceramic separator technology is a key differentiator, offering potential advantages over other solid-state battery designs.

However, QuantumScape must demonstrate the scalability and cost-effectiveness of its technology to compete effectively with established battery manufacturers. The company’s ability to deliver on its promises will determine its success in the competitive EV battery market.

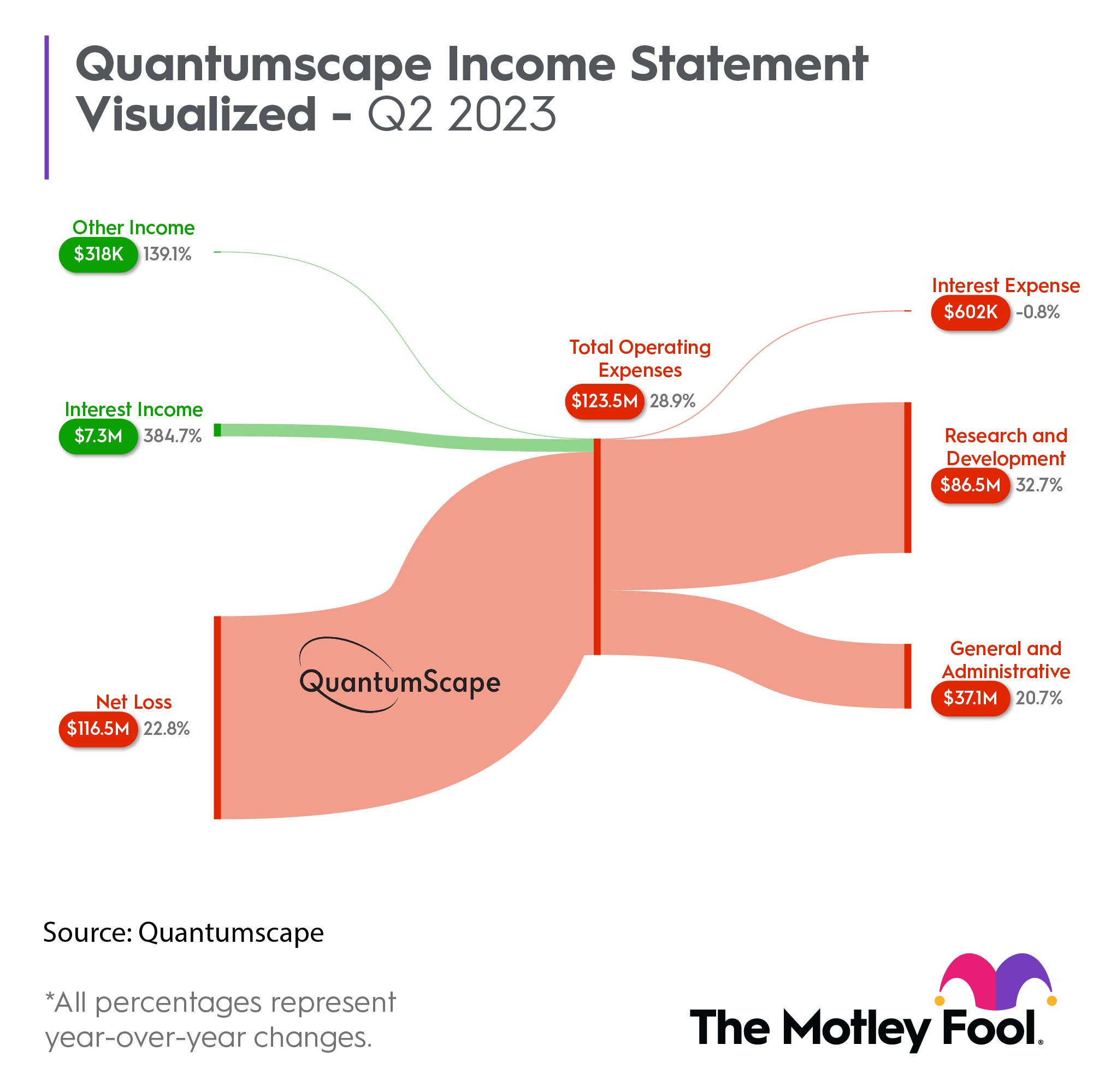

A look at QuantumScape’s cash flow and financial status as of Q2 2023, which plays a significant role in determining whether or not you should buy QuantumScape stock right now.

Future Outlook and Predictions

Assessing the future outlook for QuantumScape involves considering various factors, including technological advancements, market trends, and financial projections.

Technological Roadmap

QuantumScape’s future depends on its ability to execute its technological roadmap and achieve key milestones. The company aims to scale production of its solid-state batteries and secure partnerships with major automakers. Success in these areas would significantly enhance its prospects and drive stock appreciation.

However, delays or setbacks in its technological development could negatively impact the company’s future. Investors should closely monitor QuantumScape’s progress and adjust their expectations accordingly.

Market Projections

Market projections for the EV battery market are generally positive, driven by the increasing demand for electric vehicles and the transition away from fossil fuels. This trend creates a favorable environment for QuantumScape, provided it can successfully commercialize its technology.

However, the EV battery market is also subject to rapid technological changes and intense competition. QuantumScape must continue to innovate and adapt to stay ahead of the curve and capture a significant share of the market.

Key Takeaways

- QuantumScape is a high-risk, high-reward investment opportunity.

- The company’s solid-state battery technology has the potential to revolutionize the EV market.

- QuantumScape faces significant technological, financial, and competitive challenges.

- A long-term investment horizon and diversification are crucial for managing risk.

- Staying informed about the company’s progress and market trends is essential for making informed decisions.

For further insights, consider related coverage on QuantumScape’s recent performance and future potential.

FAQ

Is QuantumScape a good long-term investment?

QuantumScape could be a good long-term investment if its solid-state battery technology is successfully commercialized. However, it’s a high-risk investment due to technological, financial, and competitive challenges.

What are the main risks of investing in QuantumScape?

The main risks include technological hurdles, financial constraints, intense competition, and market volatility. The company’s success depends on overcoming these challenges.

How does QuantumScape compare to its competitors?

QuantumScape aims to differentiate itself through its unique solid-state battery technology, which promises higher energy density, faster charging, and improved safety compared to traditional lithium-ion batteries. However, it faces competition from established battery manufacturers and other companies developing advanced battery technologies.

What is the current analyst rating for QuantumScape?

Analyst ratings vary, reflecting the uncertainty surrounding the company’s future. Some analysts are optimistic, while others are more cautious. Investors should consider a range of opinions and conduct their own due diligence.

What is solid-state battery technology?

Solid-state battery technology replaces the liquid electrolyte found in traditional lithium-ion batteries with a solid electrolyte. This promises higher energy density, faster charging, and improved safety.

What is QuantumScape’s partnership with Corning?

QuantumScape’s partnership with Corning focuses on developing solid-state battery separators, which are critical for battery performance and safety. This collaboration aims to leverage Corning’s expertise in glass technology to enhance QuantumScape’s battery design.

What factors influence QuantumScape’s stock price?

QuantumScape’s stock price is influenced by technological milestones, partnerships, market sentiment, and financial reports. Positive news tends to drive the stock upward, while negative news can lead to corrections.

How can I stay informed about QuantumScape’s progress?

Investors should regularly monitor QuantumScape’s financial reports, technological developments, and partnerships. They should also stay abreast of broader trends in the EV market and the competitive landscape.

Conclusion

Deciding whether to buy QuantumScape stock right now requires careful consideration of its potential and the inherent risks. The company’s innovative solid-state battery technology offers a compelling vision for the future of electric vehicles, but its financial health and the competitive landscape present significant challenges. A long-term investment perspective, coupled with a diversified portfolio, is essential for those willing to navigate the volatility. Staying informed and closely monitoring QuantumScape’s progress will be crucial in determining whether this stock aligns with your investment goals. As a next step, consider consulting with a financial advisor to assess your risk tolerance and investment strategy in light of QuantumScape’s unique profile.