Apple has reached a monumental milestone, becoming the first company to achieve a $4 trillion market capitalization. This valuation underscores Apple’s dominance in the technology sector and its profound impact on the global economy. The achievement is a testament to the company’s innovative products, loyal customer base, and effective leadership.

This remarkable feat places Apple in a league of its own, further solidifying its position as one of the world’s most valuable and influential companies. The journey to this valuation has been marked by strategic decisions, technological advancements, and a relentless pursuit of excellence.

A Closer Look at Apple’s $4 Trillion Valuation

Factors Driving Apple’s Growth

Several key factors have contributed to Apple’s impressive growth and ultimate attainment of a $4 trillion valuation. These include a strong product ecosystem, consistent innovation, and a powerful brand reputation.

Apple’s ecosystem, comprising hardware, software, and services, creates a seamless user experience that fosters customer loyalty. Products like the iPhone, iPad, Mac, and Apple Watch are deeply integrated, encouraging users to stay within the Apple ecosystem. This integration provides a competitive advantage and drives recurring revenue.

Innovation is at the heart of Apple’s success. The company consistently introduces new and improved products, pushing the boundaries of technology and design. From the original Macintosh to the iPhone, Apple has a history of disrupting industries and setting new standards. This commitment to innovation keeps customers engaged and attracts new users.

Apple’s brand is synonymous with quality, design, and innovation. The company has cultivated a strong brand reputation over decades, building trust and loyalty among its customers. This brand equity allows Apple to command premium prices and maintain a competitive edge.

Key Products and Services Contributing to Revenue

Apple’s revenue streams are diverse, encompassing a range of products and services that cater to different customer needs. The iPhone remains the company’s flagship product, generating a significant portion of its overall revenue. Other important revenue drivers include the iPad, Mac, Apple Watch, and a growing portfolio of services.

Services such as Apple Music, iCloud, Apple TV+, and the App Store have become increasingly important to Apple’s financial performance. These services provide recurring revenue and contribute to the company’s overall profitability. As Apple continues to expand its services offerings, this revenue stream is expected to become even more significant.

The App Store, in particular, is a major source of revenue for Apple. The company earns a commission on all sales made through the App Store, generating billions of dollars in revenue each year. The App Store also provides a platform for developers to reach a vast audience, further strengthening Apple’s ecosystem.

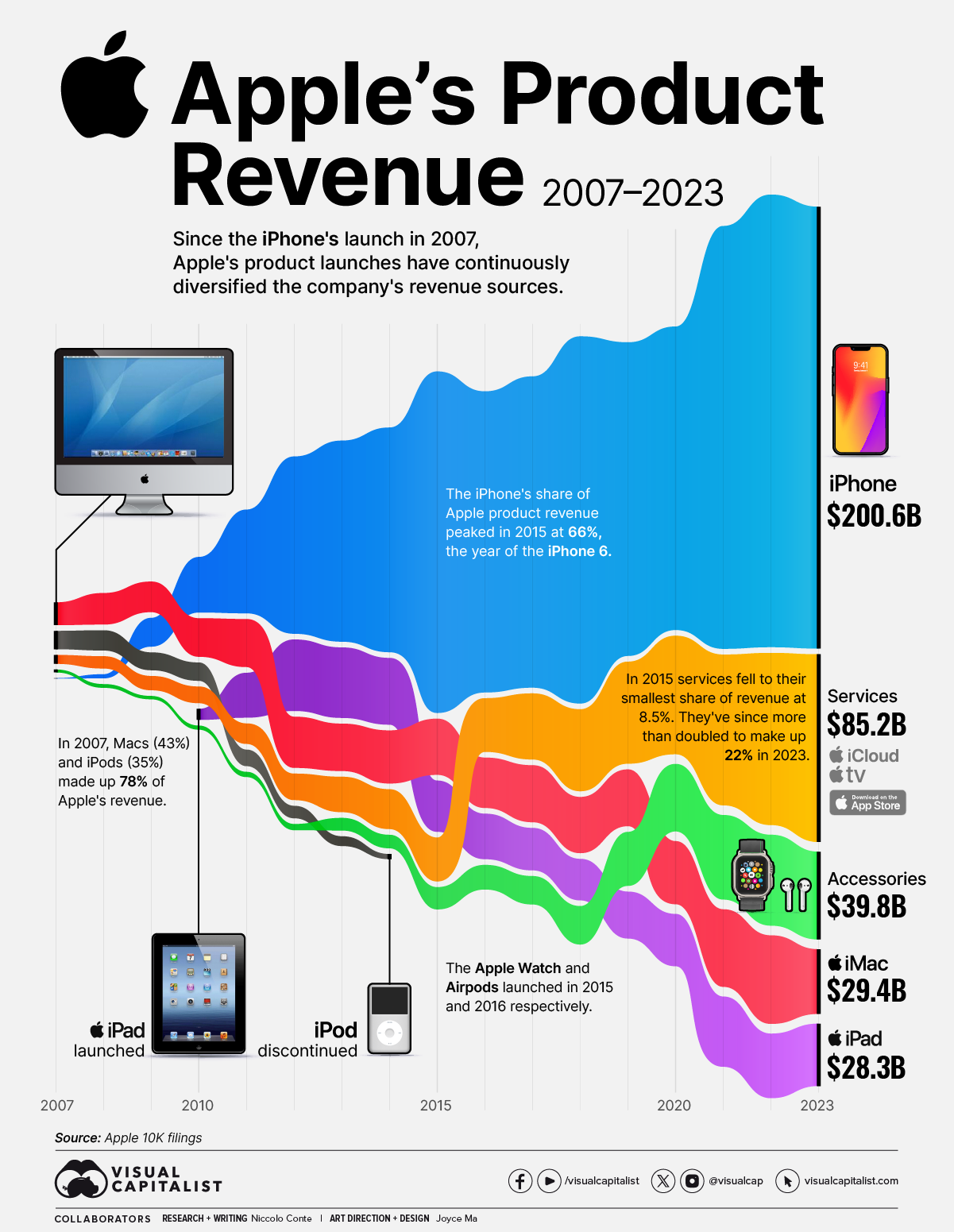

A breakdown of Apple’s revenue by product category, illustrating the diverse revenue streams contributing to its $4 trillion valuation.

Historical Milestones in Apple’s Valuation Journey

Apple’s journey to a $4 trillion valuation has been marked by several significant milestones. The company’s initial public offering (IPO) in 1980 was a pivotal moment, marking the beginning of its ascent to become a tech industry giant. Over the years, Apple has faced challenges and setbacks, but it has consistently rebounded, demonstrating its resilience and adaptability.

The introduction of the iPod in the early 2000s marked a turning point for Apple, signaling its ability to innovate beyond traditional computing. The iPod revolutionized the music industry and paved the way for future product successes. This was followed by the launch of the iPhone in 2007, which transformed the mobile phone market and solidified Apple’s position as a leader in consumer electronics.

Apple’s valuation surpassed $1 trillion in 2018, making it the first publicly traded U.S. company to reach this milestone. This was followed by a $2 trillion valuation in 2020 and a $3 trillion valuation in 2022. Each of these milestones reflected Apple’s continued growth and its ability to generate value for its shareholders.

Comparing Apple to Other Tech Giants

Apple vs. Microsoft: A Market Cap Comparison

Apple and Microsoft are two of the world’s most valuable companies, often vying for the top spot in terms of market capitalization. While Apple has recently achieved a $4 trillion valuation, Microsoft is also a formidable competitor, with a market cap that often rivals Apple’s. Both companies have demonstrated strong growth and innovation over the years, but they have taken different paths to success.

Apple’s focus on consumer electronics and premium products has helped it build a loyal customer base and command high prices. Microsoft, on the other hand, has focused on software, cloud computing, and enterprise solutions. Both companies have diversified their businesses in recent years, but their core strengths remain distinct.

The competition between Apple and Microsoft is likely to continue for the foreseeable future, as both companies seek to innovate and expand their market share. While Apple has achieved a $4 trillion valuation, Microsoft remains a strong contender, and the race for the top spot is far from over. You can read more about the competition between these tech giants in related coverage.

The Competitive Landscape: Amazon, Google, and Beyond

In addition to Microsoft, Apple faces competition from other tech giants such as Amazon, Google (Alphabet), and Facebook (Meta). These companies are all vying for dominance in various sectors of the technology industry, including e-commerce, cloud computing, search, and social media.

Amazon’s strength lies in its e-commerce platform and its growing cloud computing business, Amazon Web Services (AWS). Google dominates the search engine market and has expanded into areas such as artificial intelligence, autonomous vehicles, and healthcare. Facebook, despite facing challenges related to privacy and regulation, remains a major player in social media and digital advertising.

The competitive landscape in the technology industry is constantly evolving, with new players emerging and existing companies adapting to changing market conditions. Apple’s ability to maintain its competitive edge will depend on its continued innovation, its ability to adapt to new technologies, and its success in expanding into new markets.

Predictions: Companies That Could Surpass Apple

While Apple’s $4 trillion valuation is a remarkable achievement, some analysts predict that other companies could eventually surpass Apple in terms of market capitalization. These predictions are based on various factors, including growth potential, market trends, and technological advancements.

One potential contender is Microsoft, which has been experiencing strong growth in its cloud computing business. Another company that could potentially surpass Apple is Amazon, which has a dominant position in e-commerce and a rapidly growing cloud computing business. Other companies that are often mentioned as potential contenders include Google and Facebook.

It is important to note that these are just predictions, and the future is uncertain. The technology industry is constantly evolving, and new companies could emerge that disrupt the existing order. Apple’s ability to maintain its position as one of the world’s most valuable companies will depend on its ability to adapt to change and continue to innovate.

Implications of Apple’s Valuation

Impact on the Stock Market and Investors

Apple’s $4 trillion valuation has significant implications for the stock market and investors. As one of the largest and most influential companies in the world, Apple’s performance has a direct impact on major stock indices such as the S&P 500 and the Dow Jones Industrial Average.

Apple’s stock is widely held by institutional investors, such as pension funds and mutual funds, as well as individual investors. The company’s strong performance has generated significant returns for these investors, contributing to overall wealth creation. However, Apple’s size also means that its stock can be subject to volatility, and any significant decline in its share price could have a ripple effect on the broader market.

For investors, Apple’s $4 trillion valuation serves as a reminder of the potential for long-term growth and value creation in the technology sector. However, it also highlights the importance of diversification and risk management, as no single company is immune to market fluctuations and economic downturns.

Broader Economic Significance

Apple’s economic impact extends far beyond the stock market. The company is a major employer, both directly and indirectly, and it contributes significantly to economic growth through its investments in research and development, manufacturing, and marketing.

Apple’s products and services have transformed industries ranging from music and entertainment to communication and healthcare. The company’s innovations have created new markets and business opportunities, driving economic growth and improving people’s lives. Apple’s success has also inspired other companies to innovate and compete, further contributing to economic dynamism.

However, Apple’s size and influence also raise questions about its role in the global economy. Some critics argue that the company has too much power and that it engages in anti-competitive practices. Others argue that Apple’s success is a testament to the power of innovation and free markets. Regardless of one’s perspective, it is clear that Apple’s economic significance is undeniable.

Future Outlook and Potential Challenges

Looking ahead, Apple faces both opportunities and challenges. The company has the potential to continue growing and innovating, expanding into new markets and developing new products and services. However, it also faces challenges such as increasing competition, regulatory scrutiny, and changing consumer preferences.

One of the biggest challenges facing Apple is the increasing competition in the smartphone market. Companies such as Samsung, Google, and Huawei are all vying for market share, and they are developing increasingly sophisticated devices. Apple will need to continue innovating to maintain its competitive edge in this market.

Another challenge facing Apple is regulatory scrutiny. The company is facing antitrust investigations in several countries, and it is under pressure to change its App Store policies. These regulatory challenges could potentially impact Apple’s business model and its profitability.

Key Takeaways

- Apple has achieved a $4 trillion market capitalization, a historic milestone.

- The company’s success is driven by its strong product ecosystem, consistent innovation, and powerful brand reputation.

- Apple faces competition from other tech giants such as Microsoft, Amazon, and Google.

- The company’s valuation has significant implications for the stock market, investors, and the broader economy.

- Apple faces both opportunities and challenges as it looks to the future.

FAQ

What does market capitalization mean?

Market capitalization, often called “market cap,” represents the total value of a company’s outstanding shares of stock. It’s calculated by multiplying the current share price by the number of shares outstanding. It’s a quick way to gauge a company’s overall size.

How did Apple reach a $4 trillion valuation?

Apple’s success can be attributed to a combination of factors, including its innovative products, loyal customer base, and effective leadership. The iPhone, iPad, Mac, and Apple Watch have all contributed to the company’s revenue growth. The company’s services, such as Apple Music, iCloud, and the App Store, have also become increasingly important.

What are the risks of investing in Apple stock?

While Apple has a strong track record, there are always risks associated with investing in any stock. These risks include market volatility, competition from other companies, regulatory scrutiny, and economic downturns. It is important to diversify your portfolio and not put all your eggs in one basket.

What is Apple’s strategy for future growth?

Apple’s strategy for future growth includes expanding into new markets, developing new products and services, and investing in research and development. The company is also focused on strengthening its ecosystem and building closer relationships with its customers.

Could another company surpass Apple’s valuation?

It’s certainly possible. The technology landscape is constantly shifting. Companies like Microsoft, Amazon, and Google are all strong contenders, and new players could emerge. The key is continued innovation and adaptation to changing market conditions.

In conclusion, Apple’s achievement of a $4 trillion market capitalization is a testament to its enduring innovation, brand strength, and strategic vision. While the future holds both opportunities and challenges, Apple’s legacy as a tech industry leader is firmly cemented. Investors and consumers alike will be watching closely to see what the company does next. Perhaps exploring Apple’s product lines is your next step.