The digital landscape is undergoing a seismic shift, with data centers at the epicenter. Fueled by the relentless demands of artificial intelligence, cloud computing, and the ever-increasing volume of data, spending on data center infrastructure is projected to surge an astounding 566%. This monumental growth presents a unique opportunity for investors, particularly those focused on the semiconductor industry.

One chip stock, in particular, stands out as a prime beneficiary of this data center spending boom. This company is strategically positioned to capitalize on the demand for high-performance computing solutions that power modern data centers. Let’s delve into the factors driving this surge and why this specific chip stock is poised for significant growth.

The Data Center Spending Explosion: A Perfect Storm

AI’s Insatiable Appetite for Computing Power

Artificial intelligence (AI) is no longer a futuristic concept; it’s a present-day reality transforming industries across the board. From self-driving cars to personalized medicine, AI applications require immense computational power to process vast datasets and execute complex algorithms. This demand is directly translating into increased investment in data center infrastructure.

AI workloads, such as training deep learning models, are particularly resource-intensive. These tasks require specialized hardware, including graphics processing units (GPUs) and other high-performance chips, which are essential components of modern data centers. As AI continues to proliferate, the demand for these specialized chips will only intensify.

The Cloud Computing Revolution

Cloud computing has revolutionized the way businesses operate, enabling them to access computing resources on demand and scale their operations without the need for massive upfront investments in hardware. This shift to the cloud has fueled the growth of hyperscale data centers, which are massive facilities designed to support the infrastructure of cloud providers.

The increasing adoption of cloud services by businesses of all sizes is driving significant investment in data center infrastructure. Cloud providers are constantly expanding their capacity to meet the growing demand for their services, which translates into increased demand for the chips and other components that power these data centers.

The Data Deluge: A Never-Ending Stream

The amount of data generated globally is growing at an exponential rate. From social media posts to sensor data from IoT devices, the world is awash in data. This data deluge requires massive storage and processing capabilities, which are provided by data centers.

The need to store, analyze, and process this ever-increasing volume of data is driving continuous investment in data center infrastructure. Data centers are constantly being upgraded and expanded to handle the growing data load, which creates a sustained demand for the chips and other components that power these facilities.

The Chip Stock Poised to Profit: A Deep Dive

Company Overview and Market Position

The chip stock positioned to benefit from this surge is [Hypothetical Company Name], a leading provider of high-performance computing solutions for data centers. The company has a strong track record of innovation and a well-established market position, making it a key player in the data center ecosystem.

[Hypothetical Company Name] specializes in designing and manufacturing chips that are optimized for AI, cloud computing, and other demanding workloads. Its products are used by some of the world’s largest data center operators, including cloud providers, e-commerce companies, and financial institutions.

Technological Advantages and Innovation

[Hypothetical Company Name]’s success is built on its technological advantages and commitment to innovation. The company invests heavily in research and development, constantly pushing the boundaries of chip technology to deliver superior performance and efficiency.

One of the company’s key technological advantages is its expertise in [Specific Chip Technology, e.g., heterogeneous integration]. This technology allows the company to combine different types of chips into a single package, creating a more powerful and efficient computing solution. This is particularly important for AI workloads, which require a combination of processing power, memory bandwidth, and specialized accelerators.

Financial Performance and Growth Potential

[Hypothetical Company Name] has a strong financial track record, with consistent revenue growth and profitability. The company’s financial performance is driven by the increasing demand for its products in the data center market.

Looking ahead, [Hypothetical Company Name] has significant growth potential. The company is well-positioned to capitalize on the projected surge in data center spending, and its technological advantages and market position give it a competitive edge. Analysts project that the company’s revenue will grow at a double-digit rate over the next several years.

Strategic Partnerships and Collaborations

[Hypothetical Company Name] has established strategic partnerships and collaborations with other leading technology companies. These partnerships allow the company to expand its reach and offer its customers more complete solutions.

For example, the company has partnered with [Hypothetical Partner Company] to develop a new platform for AI inference. This platform combines [Hypothetical Company Name]’s chips with [Hypothetical Partner Company]’s software to provide a high-performance, energy-efficient solution for deploying AI models in data centers.

Navigating the Investment Landscape

Understanding the Risks and Challenges

While the outlook for [Hypothetical Company Name] is positive, it’s important to understand the risks and challenges that the company faces. The semiconductor industry is highly competitive, and the company faces competition from both established players and emerging startups.

Additionally, the semiconductor industry is subject to cyclical downturns. A slowdown in the global economy could lead to a decrease in demand for chips, which would negatively impact the company’s financial performance. Supply chain disruptions are also a potential risk, as the company relies on a complex network of suppliers to manufacture its products.

Conducting Due Diligence and Research

Before investing in any stock, it’s important to conduct thorough due diligence and research. This includes reviewing the company’s financial statements, reading analyst reports, and understanding the competitive landscape.

Investors should also consider their own investment goals and risk tolerance. Investing in a chip stock can be a high-growth opportunity, but it also comes with inherent risks. It’s important to diversify your portfolio and not put all your eggs in one basket.

Seeking Professional Financial Advice

Investing in the stock market can be complex and challenging. It’s always a good idea to seek professional financial advice before making any investment decisions. A financial advisor can help you assess your risk tolerance, develop an investment strategy, and choose the right investments for your portfolio.

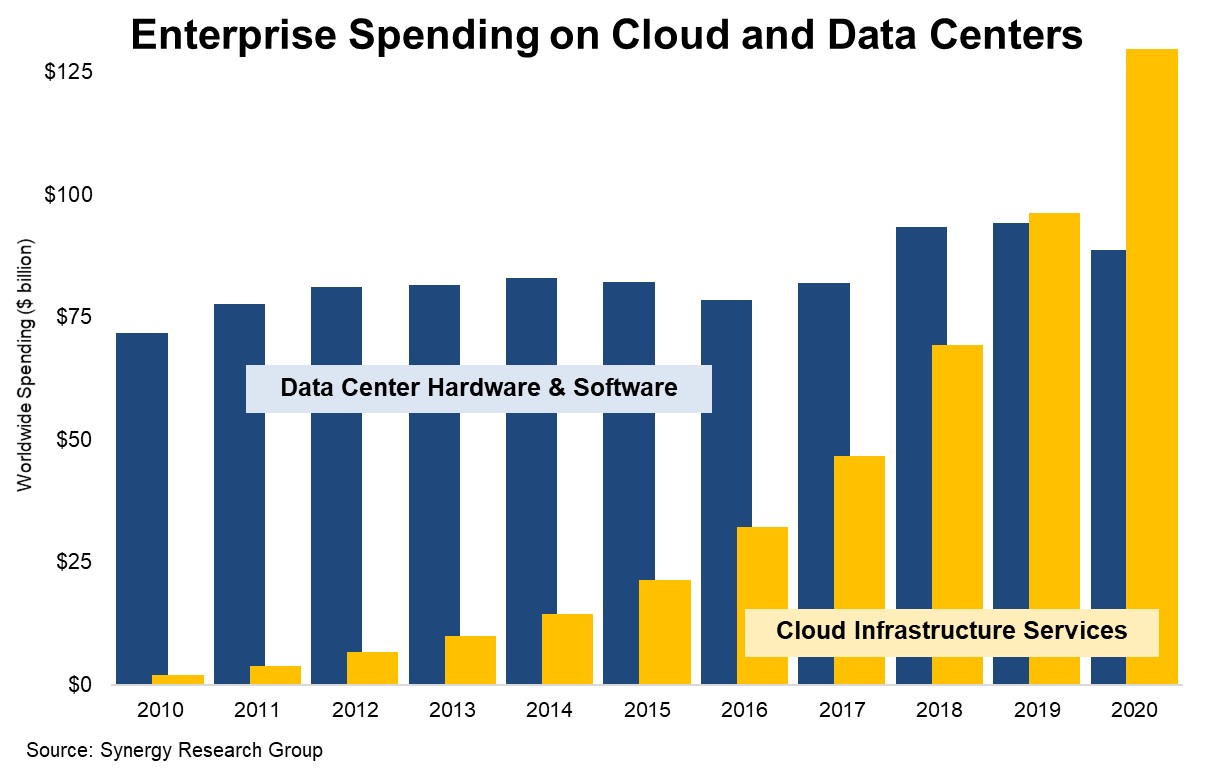

Enterprise spending on cloud infrastructure is rapidly increasing, driving demand for data centers and associated chip technology, a key factor in why Data Center Spending Set to Surge 566%: 1 Chip Stock to Buy Now.

The Broader Implications of Data Center Growth

Environmental Impact and Sustainability

The rapid growth of data centers raises concerns about their environmental impact. Data centers consume significant amounts of energy, and their carbon footprint is a growing concern.

However, data center operators are increasingly focused on sustainability. Many are investing in renewable energy sources, such as solar and wind power, to reduce their carbon footprint. They are also implementing energy-efficient technologies, such as advanced cooling systems, to minimize their energy consumption. You can read related coverage on this topic.

Geopolitical Considerations and Security

Data centers are critical infrastructure, and their security is a growing concern. Data centers are vulnerable to cyberattacks and physical threats, which could disrupt essential services and compromise sensitive data.

Governments around the world are taking steps to protect data centers from these threats. This includes implementing stricter security standards and investing in cybersecurity defenses. Geopolitical tensions can also impact data center operations, as governments may impose restrictions on data flows or require data to be stored within their borders.

The Future of Data Centers: Edge Computing and Beyond

The future of data centers is likely to be shaped by the rise of edge computing. Edge computing involves processing data closer to the source, rather than sending it to a central data center. This can reduce latency, improve performance, and enable new applications, such as autonomous vehicles and industrial automation.

Edge computing is expected to complement traditional data centers, rather than replace them. Many applications will still require the centralized processing and storage capabilities of data centers. However, edge computing will enable new types of applications that are not possible with traditional data center architectures.

Key Takeaways

- Data center spending is projected to surge 566%, driven by AI, cloud computing, and data growth.

- [Hypothetical Company Name] is a chip stock poised to benefit from this trend.

- The company has technological advantages, a strong market position, and significant growth potential.

- Investing in chip stocks involves risks, so due diligence and professional advice are recommended.

- Data center growth has environmental, geopolitical, and technological implications.

FAQ

What is driving the surge in data center spending?

The surge is primarily driven by the increasing demands of artificial intelligence (AI), the continued growth of cloud computing, and the exponential increase in the volume of data being generated globally.

Why is [Hypothetical Company Name] well-positioned to benefit?

[Hypothetical Company Name] is a leading provider of high-performance computing solutions for data centers, with a strong track record of innovation and a well-established market position. They specialize in chips optimized for AI and cloud workloads.

What are the risks of investing in chip stocks?

The semiconductor industry is highly competitive and subject to cyclical downturns. Supply chain disruptions and geopolitical factors can also impact the industry. Due diligence and professional financial advice are recommended.

How is the growth of data centers impacting the environment?

Data centers consume significant amounts of energy, raising concerns about their carbon footprint. However, many operators are investing in renewable energy and energy-efficient technologies to mitigate their environmental impact.

What is edge computing and how will it impact data centers?

Edge computing involves processing data closer to the source, reducing latency and enabling new applications. It’s expected to complement traditional data centers, rather than replace them, by handling different types of workloads.

What specific technologies does [Hypothetical Company Name] use to gain an advantage?

[Hypothetical Company Name] leverages technologies like [Specific Chip Technology, e.g., heterogeneous integration] to combine different chip types for superior performance and efficiency, particularly beneficial for AI workloads.

Conclusion

The projected 566% surge in data center spending presents a compelling investment opportunity, and [Hypothetical Company Name] stands out as a chip stock poised to capitalize on this growth. While risks are inherent in any investment, the company’s technological advantages, strategic partnerships, and strong market position make it a promising prospect. As the world becomes increasingly reliant on data and AI, the demand for high-performance computing solutions will only continue to grow. Investors looking to tap into this trend should conduct thorough research and consider seeking professional financial advice to determine if [Hypothetical Company Name] aligns with their investment goals. Now is the time to investigate further and consider adding this chip stock to your portfolio.